Ami Organics Ipo Lot Size - Q8u Zlxhsd6yhm

The company is ready to offer Rs 665 Crores and a fresh issue of Rs 300 Crores. Ami Organics IPO Price Band.

Ami Organics Ipo Gmp Date Review Important Details 2021

A retail-individual investor can apply for up to 13 lots 312 shares or 190320.

Ami organics ipo lot size. Check issue price lot size and other details The price band for Gujarat based company has been fixed at Rs 603-610 per share. 24 Shares 136183 Forms Retail Min Application. Ami Organics IPO Price Band Per Equity Share.

The company re-filed DRHP on June 08 2021 that revised version of 2018. If you are planning to invest in this IPO then you must know these 10 basic information about this public issue. Ami Organics IPO Lot Size The Ami Organics IPO market lot size is 24 shares.

So far this year Ami Organics IPO is the 40th issue. Full timeline including ALLOTMENT LISTING Ami Organics Limited IPO The Initial Public Offering IPO of Ami Organics Limited will be opening next week 1 September. Ami Organics Centre Initial Public Offerings Investment Note.

Ami Organics Limited IPO The Initial Public Offering IPO of Ami Organics Limited will be opening next week 1 September. Ami Organics IPO opens on September 1. While the offer for sale is Rs 365 Crores.

The bid lot is 24 shares which is a multiple of that. Ami Organics IPO allotment status is not available at this time. Ami Organics IPO Dates Review Price Form Lot Size Allotment Details 2021 Facebook 0 Twitter 0 LinkedIn Messenger Tumblr 0 WhatsApp Pinterest 0 0 Shares Post navigation.

The company plans to raise Rs 56963 crore at the higher end of the price band. Registrar of the Ami Organics IPO is responsible for IPO. Check grey market premium price band lot size bid details Ami Organics Rs 56963-crore IPO will open for subscription on 1 September 2021 at a price of Rs 603-610 per equity share of face value of Rs 10 each.

603-610 Ami Organics IPO Lot Size 24 Shares Ami Organics Listing will at BSENSE. The Lot size for this IPO is 24 and is available at a price of 603-610 Based on the Company Financials for 31-Mar-21 the companys Asset was 413268 Cr Revenue was 341988 Cr and Profit was 53999 Cr. Shares offered to QIB 50 4669144 Shares Rs 28482 Crs NII 15 1400744 Shares Rs 8544 Crs RII 35 3268400 Shares Rs 19937 Crs Lot size.

Ami Organics Limited shares were trading at a premium of per equity share in the grey market. Ami Organics in consultation with book-running lead managers has undertaken a pre-IPO placement of equity shares worth Rs 100 crore. Ami Organics is one of the major.

The ticket size is Re1 while the face value is Rs10. Please revisit us to check the latest updates for Ami Organics Limited IPO allotment status. Investors can bid for a minimum of 24 equity shares and in multiples.

Ami Organics Rs 56963-crore IPO will open for subscription on 1 September 2021 at a price of Rs 603-610 per equity share of face value of Rs 10 each. Ami Organics Limited IPO Top 10 things to know- issue date price band lot size MORE. Each share has a face value of Rs10 although the IPOs price range is Rs 603 to Rs 610.

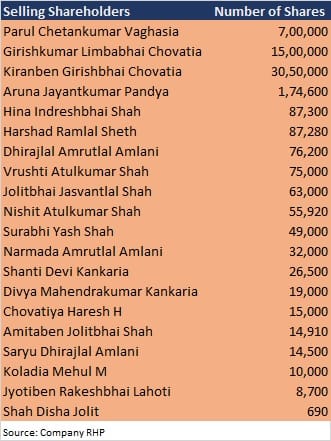

Issue Size An IPO consists of an initial public offering of up to 200 cr and a maximum of 6059600 shares for sale OFSThe problem is 100 book building Price range Rs603 to Rs610. Check this IPO note for IPO details such as openingclosing date issue size lot size financials of the company and much more. Ami Organic IPO Overview and Price Band The IPO consists of a fresh issue of Rs 200 crore and an offer for sale OFS of 6059600 equity shares by 20 shareholders.

This Initial Public Offering IPO of X Equity Shares of Rs10 each for cash at a price range of Rs 603 to Rs 610 per. The three-day IPO will close on 3 September. Ami Organics IPO Equity Size.

The size of fresh issue has been reduced by Rs 100 crore. The IPO comprises 300 crores of fresh issue and offer for sale up to 6059600 equity shares of existing share holders. Ami organics IPO issue will open on 1st September and it will close on 3rd September.

With the founding of Ami Group we embarked on a mission to convert rational capital into speciality chemicals. 4 what is the lot size of Ami organics IPO. Ami Organics Rs 570-crore IPO opens Sep 1.

Ami Organics IPO Date Price Market Lot Details About Ami Organics IPO We at Ami Organics Limited aspire to be a Globally Integrated Intermediate Company by focusing on three key areas Innovation Quality and Technology. When will Ami organics IPO open for subscription. IPO share allotment process takes 6 working days from the issue closing date.

The face value of the IPO is 10. The AMI Organics IPO is might be open from 25th August 2021. Here you will know various details including AMI Organics IPO date price GMP and subscription status.

Ami Organics Limited IPO Top 10 things to know- issue date price band. Ami Organics IPO date are finalized and the IPO to hit the market on 01 September 2021. Also know the complete timeline.

The three-day IPO will close on 3 September.

Ami Organics Ipo Coming Soon Price Gmp Company Financials Should You Subscribe

Specialty Chemicals Firm Ami Organics Ipo To Open On September 1

Ami Organics Ipo Opens Today Gmp Price Company Review Risks Should You Subscribe

Ami Organics Ipo Dates Review Price Form Lot Size Allotment Details 2021

Ami Organics Ipo Date Review Price Form Market Lot Details Hindisip Com