Ami Organics Ipo Size : E2pngg7gmq5obm

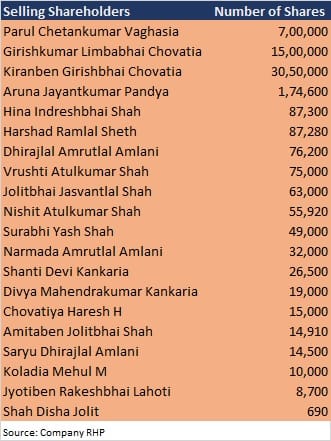

Ami Organics IPO consists of a fresh issue worth Rs 300 crore and an offer for sale OFS of up to 6059600 shares by existing shareholders Ami Organics IPO. The IPO comprises 300 crores of fresh issue and offer for sale up to 6059600 equity shares of existing share holders.

Check GMP issue dates size price Photo Credit.

Ami organics ipo size. They have developed and commercialized over 450 Pharma Intermediates for APIs across 17 key therapeutic areas since inception and NCE with a strong focus on RD across select high-growth high margin therapeutic areas such as anti-retroviral anti-inflammatory anti-psychotic anti-cancer anti-Parkinson anti-depressant and anticoagulant for use. The company is ready to offer Rs 665 Crores and a fresh issue of Rs 300 Crores. The minimum order quantity is 24 Shares.

Ami Organics Limited a specialty chemicals firm is all set to open its three-day initial public offer for subscription from September 1-3 2021. Each share has a face value of Rs10 although the IPOs price range is Rs 603 to Rs 610. Here are all the details about the offer.

The IPO opens on Sep 1 2021 and closes on Sep 3 2021. The issue is priced at 603 to 610 per equity share. Ami Organic IPO Overview and Price Band The IPO consists of a fresh issue of Rs 200 crore and an offer for sale OFS of 6059600 equity shares by 20 shareholders.

The Registrar for Ami Organics IPO is Link Intime India Private Limited. The chemical maker plans to raise Rs 56964 crore through its maiden issue. Check open and close dates price band Issue size and more.

The Lot size for this IPO is 24 and is available at a price of 603-610 Based on the Company Financials for 31-Mar-21 the companys Asset was 413268 Cr Revenue was 341988 Cr and Profit was 53999 Cr. The total IPO size of Ami Organics is Rs 56963 crores comprises fresh issue aggregating to 200 crore and Offer for Sale OFS aggregating up to 36964 crore. The company re-filed DRHP on June 08 2021 that revised version of 2018.

Here you will know various details including AMI Organics IPO date price GMP and subscription status. The public offering comprises Rs 200 crore fresh issue and an OFS Offer for Sale up to 6059600 equity shares by existing investors such as Parul Chetankumar Vaghasia Kiranben Girishbhai Chovatia and others. What is the lot size of Ami Organics IPO.

Ami Organics IPO is a main-board IPO of equity shares of the face value of 10 aggregating up to 56964 Crores. The Ami Organics IPO lot size is 24 Equity Shares and the minimum order quantity is 24 Equity Shares Who is the Registrar for Ami Organics IPO. Ami Organics IPO size.

This Initial Public Offering IPO of X Equity Shares of Rs10 each for cash at a price range of Rs 603 to Rs 610 per equity share totals Rs569640 million. Check this IPO note for IPO details such as openingclosing date issue size lot size financials of the company and much more. Ami Organics IPO size.

When will Ami organics IPO open for subscription. Ami Organics is planning to raise 56964 Crores through an IPO which consists of a fresh issue of 200 Crores worth equity and OFS Offer For Sale of 6059 lakh equity shares by existing shareholders. 4 what is the lot size of Ami organics IPO.

While the offer for sale is Rs 365 Crores. Ami Organics IPO date are finalized and the IPO to hit the market on 01 September 2021. What is the lot size of Ami Organics IPO for retail investor.

Ami organics IPO issue will open on 1st September and it will close on 3rd September. Specialty chemicals manufacturer Ami Organics IPO initial public offering will hit the street on September 01 along with Vijaya Diagnostics Centre IPO. Ami Organics Limited IPO.

The Ami Organics IPO will hit the market soon and you can apply for the IPO from 9th August to 11th August 2021. Ami Organics IPO Equity Size. Ami Organics IPO Company Overview.

The Ami Organics IPO market lot size is 24 shares. A retail-individual investor can apply for up to 13 lots 312 shares or 190320. The public offering comprises Rs 200 crore fresh issue and an OFS Offer for Sale up to 6059600 equity shares by existing investors such as Parul Chetankumar Vaghasia Kiranben Girishbhai Chovatia and others.

Link Intime India Private Ltd is the registrar for the IPO. The company on Friday has set a price band of Rs 603-610 per equity share as news agency Press Trust of India. Ami Organics Centre Initial Public Offerings Investment Note.

The AMI Organics IPO is might be open from 25th August 2021. Ami Organics IPO lot size is not yet announced. Ami Organics Limited shares were trading at a premium of per equity share in the grey market.

The company plans to raise Rs 56963 crore at the higher end of the price band. The face value of the IPO is 10. Ami Organics IPO Price Band.

Ami Organics Ipo Gmp Date Review Important Details 2021

Ami Organics Ipo Subscription Status Live Numbers Ipo Watch

Ami Organics Ipo To Open On Sept 1 Check Price Band And Other Details The Economic Times

Ami Organics Ipo Dates Review Price Form Lot Size Allotment Details 2021